View Kwsp Contribution Rate 11 PNG. This notice must be presented to employers to be submitted to the epf. The epf stated last week that all members can still maintain their the form, known as borang kwsp 17a (khas 2020), is now available for download on the epf website.

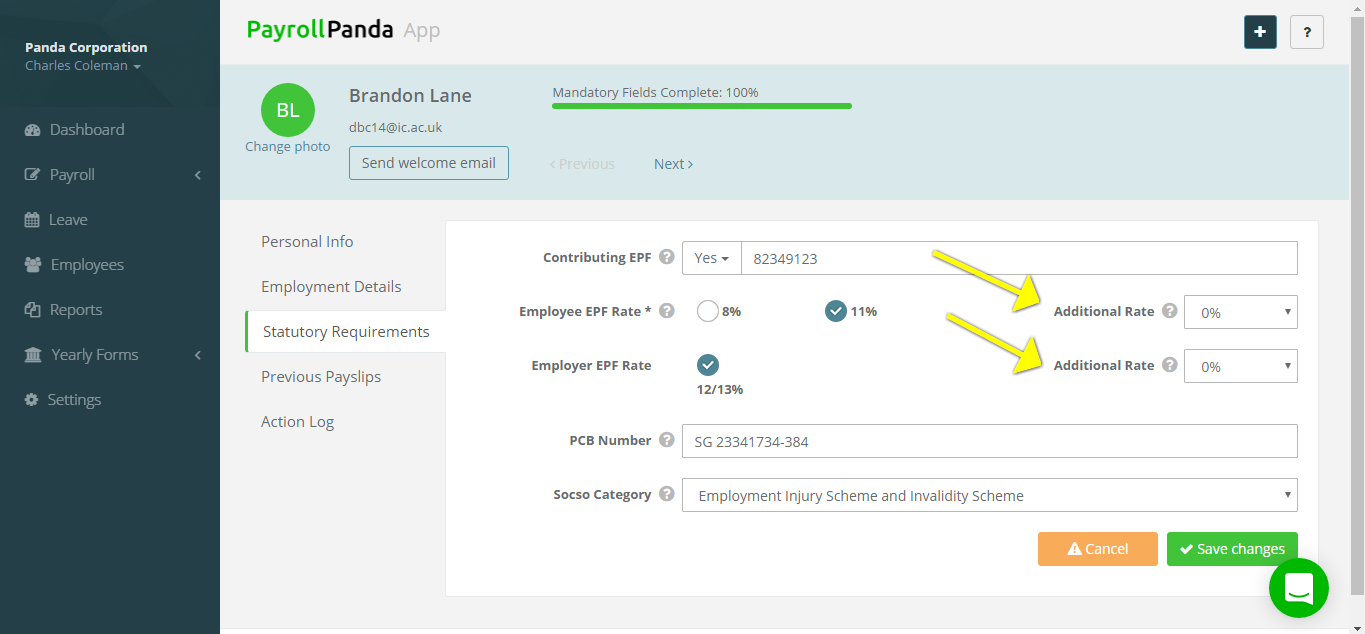

To keep the contribution rate 11%, employee can download 17a (khas 2020) form from kwsp (will be available before 2nd week of march 2020) and follow the steps below:

.of the statutory contribution to the employees provident fund (epf) at 11% can opt to fill the kwsp 17a (khas 2020) form available at its website, www.kwsp.gov.my. All you'll need is to submit form kwsp 17a (ahl) through your employer to declare that you are contributing more than the statutory rate. The dividend rate of the epf. The reduction of contribution rate was announced by the government in 2016 following the tabling of the revision of budget 2016 by y.a.b.